Finance for Accountants Stream

Finance for Accountants Stream

BACKGROUND

An interaction between accounting practices and finance explained by three PACC alumni

The roles of accounting and business finance have been redefined over time yet they continuously demonstrate interlocking relationships. Simply said, accounting is a process to record transactions to be reflected in the financial statements while professionals in business finance make financial decisions. These decisions are not made randomly but are based on reliable information. Accounting information is definitely one of such sources.

Danny Yung is the founder and Chief Investment Officer for TX Capital, a hedge fund based in Hong Kong which primarily invests in the Chinese equity markets. He manages a pool of capital from global clients and invests in Chinese stocks for long term compound growth. “In selecting opportunities, detailed accounting review will be conducted to understand the earnings quality of the companies.” Danny explained, “My team will create financial models to forecast companies’ earnings in the future and estimate a fair valuation. I am then responsible for the investment decision and portfolio construction for the firm.”

In my current role, I deeply realise the importance of possessing a solid understanding of the accounting impacts in carrying out a more logical deduction to convince my supervisors and clients – all begin with my knowledge in the PACC Programme.

– Nelson Cheung

Equity Research Analyst

(Graduate of 2017)

Nelson Cheung, who is currently working as an equity research associate in one of the international investment banks, shared similar views. “In some TV programmes, you may see financial analysts sharing their views on a particular stock summarising with a target price. You may wonder how they derive such a target and give advice. One of the mainstream valuation techniques is to leverage on accounting knowledge.” Nelson explained further, “Valuation may go very complicated but the secrets would be how thorough an analyst understands and interprets the underlying accounting treatments and how efficient he or she can adjust the financial models to respond to rapidly changing market dynamics.”

Stock market investment is not the only domain holding accounting and finance together. Corporate finance is another area under which accounting has a significant role. Corporate finance plans and implements management resources to maximise the value of a business and includes activities like capital investment appraisals, source of finances and dividend policy formulation. Before Danny established TX Capital, he worked at McKinsey’s corporate finance practice where he was advising corporations on their merger and acquisition, joint venture negotiation and strategic investments. Danny also worked at China Resources Holdings as a business director where he oversaw business operation and strategic investment. Both roles require the use of accounting information in making decisions.

To help students explore the close relationship between accounting practices and finance, the School of Accountancy introduces the Finance for Accountants (FA) stream for students admitted in the academic year 2018/19 or after. Students in FA stream are expected to utilise their accounting knowledge to analyse financial information which assists them in formulating financial strategies. At the same time, they are expected to demonstrate specialised knowledge on the operation of the financial markets, financial instruments as well as the management of financial institutions on top of the accounting knowledge learnt in their core curriculum.

I consider accounting as a knowledge-based profession. Its training is perceived as a ‘plus’ in many roles in the financial industry. Employers generally consider accountants to be analytical and detail-minded.

– Marco Sze

Partner & Portfolio Manager

OP Capital

(Graduate of 2003)

Marco Sze, who is now the partner and Portfolio Manager of OP Capital, also a hedge fund based in Hong Kong, joined one of the professional service firms as an auditor after graduation. “I obtained my CPA qualification. The skills acquired during my early career are transferrable since the accounting training is not simply on the preparation of financial statements but rather on how to analyse and interpret the accounting information presented on the financial statements.” Marco commented, “Such training on both the soft skills and technical knowledge is particularly important when one progresses to senior roles in the financial industry as decision-making becomes indispensable. If you possess accounting knowledge, you can then make financial decisions more comfortably.”

Financial statement analysis is helpful in assessing the evolution of a company’s financial health, corporate finance decisions that management have made over time and comparing them objectively against all companies.

– Danny Yung

Founder and Cheif Investment Officer

TX Capital

(Graduate of 2004)

On top of what Marco has shared, Danny elaborated on what an accountant can specifically contribute in an asset management firm. “Accounting knowledge is applicable for various roles in both front office and back office functions. For investment management, accounting is the foundation of understanding a company’s performance. A strong grasp of accounting knowledge is critical in understanding the operational, financial and business management of a company. As for back-office function, accounting knowledge or a CPA qualification would be required for a finance role where the main responsibilities include managing firm’s budgets and preparing for annual financial statements.”

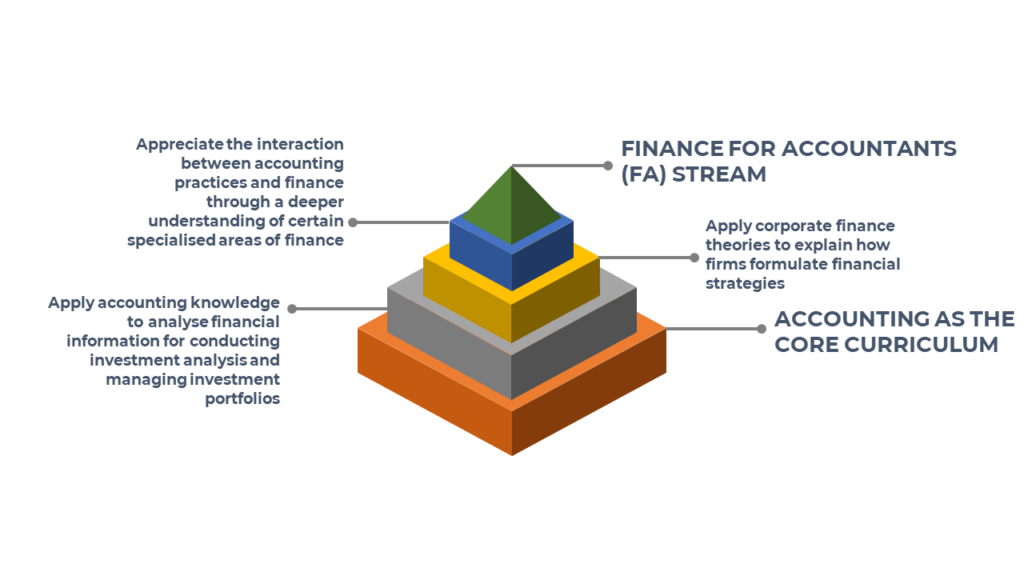

AIMS AND LEARNING OUTCOMES

Students are expected to:

1. Apply the accounting knowledge to analyse financial information for conducting investment analysis and managing investment portfolios.

2. Apply corporate finance theories to explain how firms formulate financial strategies such as capital structure and dividend payout decisions.

3. Appreciate the interaction between accounting practices and finance through a deeper understanding of certain specialised areas of finance such as international finance, operation of financial markets, financial instruments and management of financial institutions.

CURRICULUM

| Required (6 units) | Elective (6 units) | ||

|---|---|---|---|

| FINA3070 | Corporate Finance: Theory and Practice | ACCT4251 | Regulation and Compliance in the Financial Markets |

| FINA3080 | Investment Analysis and Portfolio Management | ACCT4282 | Reporting Issues in the Financial Service Industry |

| FINA3010 | Financial Markets | ||

| FINA3020 | International Finance | ||

| FINA3030 | Management of Financial Institutions | ||

| FINA4040 | Cases in Corporate Finance | ||

| FINA4050 | Mergers and Acquisitions | ||

| FINA4110 | Options and Futures | ||

Course requirements are applicable to the latest year of admission. Students are advised to check in CUSIS for their applicable course requirements for stream declaration.

Students will declare the Finance for Accountants Stream at the last term of study when they are able to complete the coursework of the Stream.